Buying a home can seem like a daunting task, particularly because it requires so much money upfront and you know that you will be paying for it for years to come. It is one of the biggest financial decisions you will make in your life, so it requires careful consideration, but there are also a lot of upsides to owning your own home. Some of these advantages include:

- Privacy and autonomy over your home

- A mortgage is more predictable and stable than rent if it is fixed rate

- Many payments that you make towards your home are tax deductible

- Pride of homeownership and sense of belonging in your community

- Equity that goes to you as you make payments

- More options, especially if you have a budget window.

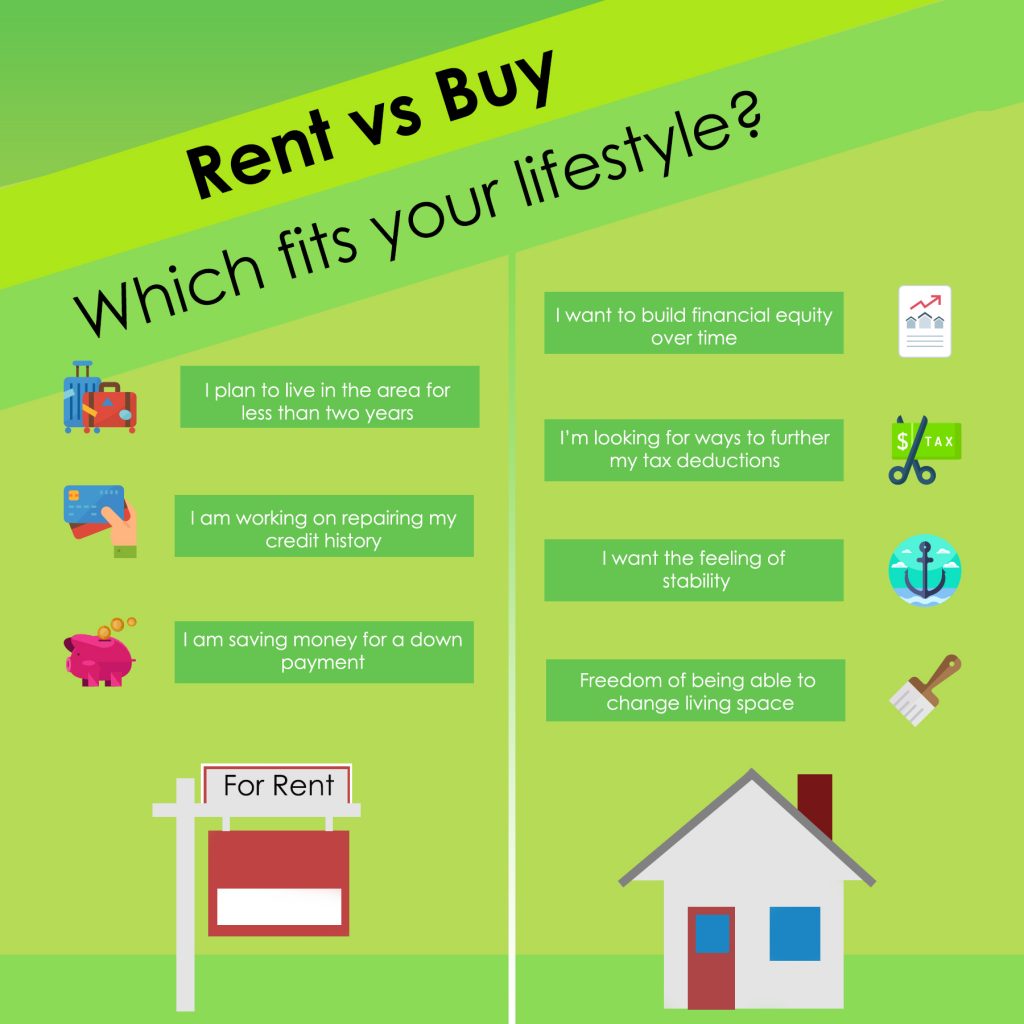

There are definitely many different factors to consider if you are weighing buying versus renting. Homeownership requires you to have a stable or growing income, as you will be making payments for a very long time. While there are significant financial benefits, they are long term so having a budget or savings plan in place before you purchase your home is critical. Also, your credit will affect your ability to buy a home more than it will your ability to rent, so knowing what your credit score is and how to improve it is another thing to consider. Overall, there are many benefits to owning a home, especially if you think you will be in one place for a while and you feel financially stable. Here is a breakdown of the benefits of owning a home vs. renting a home.